According to Warc, the amount is almost 15% higher than that of 2023

The Global Advertising Trends report, published by Warc, highlights that social platforms, in addition to dominating the global media landscape, exert great influence on the way brands reach their audiences.

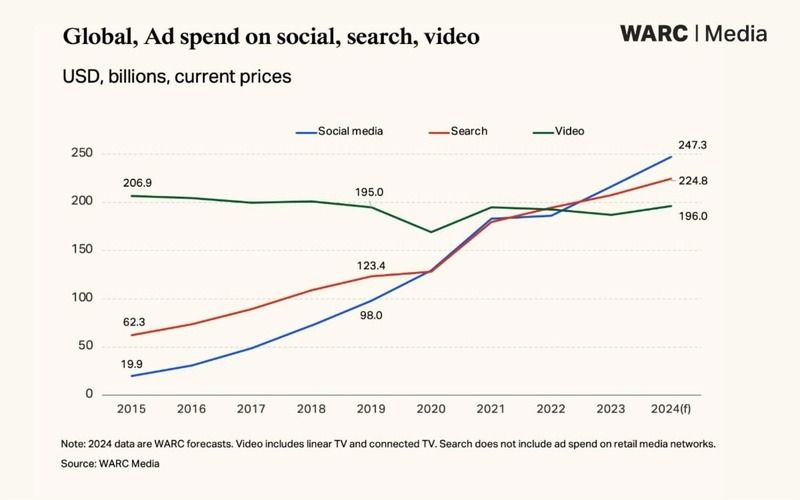

According to Warc Media forecasts, social media is now the largest channel in the world in terms of advertising investment and is expected to total US$247.3 billion in 2024, a 14.3% increase from the previous year.

Data from GWI shows that time spent on social platforms has increased by 50% since 2014, going from an average daily consumption of 95 minutes to 152 minutes in 2024 and, according to data.ai, the number of users worldwide on social platforms has increased by 169% since 2014.

“Much of social media’s success has been driven by the remarkable revival of Meta. However, social media’s dominance over budgets can also be seen in the rise of TikTok and the return to double-digit ad revenue growth on Snapchat and on Pinterest. However, with this dominance comes challenges such as increased advertising loads in social environments and the impact of AI on media planning,” says Alex Brownsell, chief content officer at Warc Media.

According to data from the report, Facebook and Instagram grew more than 20% year-on-year in the first quarter of 2024, and Meta is forecast to earn $155.6 billion in ad revenue this year, representing a 63.0% share of global social spending. According to Warc Media, Meta is expected to overtake global linear TV in terms of advertising spend by 2025.

Warc Media also predicts that TikTok will earn $23.1 billion in 2024. The 18.3% annual increase marks a significant slowdown from the 87.8% growth rate recorded last year, despite the introduction of new search and shopping ad formats.

Pinterest is expected to see a 17.3% annual increase in ad revenue in 2024, while Snapchat is expected to grow 13.7%. This strong growth of both platforms is attributed to a reorientation and tilt towards their respective strengths.

Also according to the study, it is predicted that X’s ad revenue in 2024 will decrease by 6.4% globally and 5.1% in the US. However, compared to the 46.4% drop in 2023, this marks a stabilization for the Elon Musk-owned platform, largely due to political ad spending. However, marketers remain concerned about brand safety and X’s much-publicized issues with bots.

US social media advertising spending is expected to reach $75.6 billion this year. Facebook remains the largest player, forecast to reach US$36.3 billion, followed by Instagram ($21.3 billion) and TikTok ($10.1 billion). In the UK, social media advertising spend grew by 15.6% year-on-year in 2023 and is forecast to reach £8.8 billion by 2025, according to the latest UK Spending Report. AA/Warc.

Major Chinese social platforms have seen a slowdown in ad revenue since 2021. However, signs of positivity are emerging: video and photo-sharing app Xiaohongshu, with 312 million MAUs in China, reported its first profit; and Douyin, owned by ByteDance, is forecast to earn $30.2 billion in ad revenue, $7 billion more than TikTok.

More than 70% of consumers in Asian markets, including Indonesia and the Philippines, use social media at various stages of their shopping journey. GWI data shows that social media users in APAC are 11.2% more likely than the global average to purchase a product or service weekly due to an endorsement from a social media influencer.

(Credit: Photo by dole777 on Unsplash)