IAB Brasil, the association that represents the digital advertising market in the country, launched theDigital AdSpend 2021. According to the study, carried out in partnership with theKantar IBOPE Media, BRL 30.2 billion were invested in digital advertising in the last year, an increase of 27% compared to the previous year (BRL 23.7 billion in 2020). The full report was presented first hand to the participants of theAdTech & Branding 2022an event that this week brought together professionals from the Brazilian digital advertising market and brought the main trends and current issues to the sector.

The study also reveals that more than half of the total advertising investment in digital in 2021 was destined to social media platforms (54%) – which is also reflected in the participation of mobile devices, which represented 76% of the total. share of devices. Regarding formats, 37% of investments were directed to videos, 33% to images (sum of display formats such as banners, headers, gifs and etc) and 30% to search (search sites).

According to Cris Camargo, CEO of IAB Brazil:

“Digital AdSpend data is an important reference to guide planning, changes and innovations within companies. With the sectorial view that we have been bringing since 2020, the report has evolved, becoming even more robust and strategic. In addition, based on the 2021 data, we started to build a historical basis to monitor the evolution and movement of this investment between formats, devices and sectors year by year.”

Sector rankings

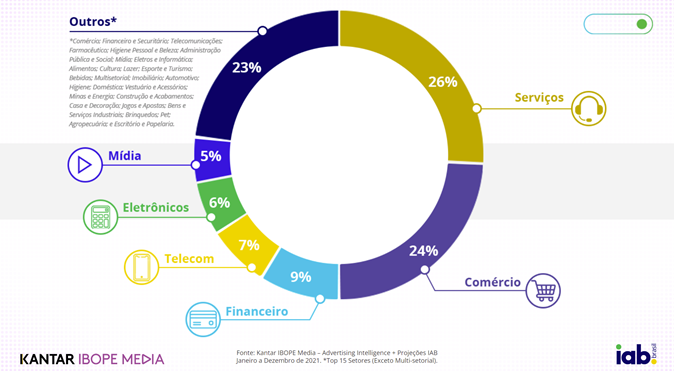

Digital AdSpend 2021 points out that 15 of the 26 industries surveyed account for 94% of total digital ad spend last year. And two of these sectors – services (26%), commerce (24%) – concentrated half of the total investment in the analyzed period. Businesses such as finance (9%), telecommunications (7%), electronics (6%) and media (5%) also stand out in terms of contribution.

Added together, the other sectors – culture, leisure, sport and tourism; real estate, personal hygiene and beauty; foods; Clothing & Accessories; drinks; automotive; pharmaceutical; public and social administration; mines and energy; House and decoration; construction and finishing; home hygiene; industrial; pet; agriculture; toys; office and stationery; gaming and betting and multi-sector – represent 23% of total investment in digital advertising in 2021.

Growth in the number of digital advertisers

The Digital AdSpend study also reveals that between 2020 and 2021 the number of advertisers who started investing in digital channels grew by 30%. This means more prospecting opportunities for agencies, publishers and platforms. In addition, the emergence of advertisers brings even more dynamism with new entrants from various sectors. The home and decor sector, for example, had 83% more advertisers in 2021 than the year before. This growth in the number of digital advertisers also occurred in the sectors of industrial goods and services (79%), mining and energy (69%), construction (59%), telecommunications (53%), commerce (47%), office and stationery (46%), hygiene and beauty (42%) and domestic hygiene (41%).

High share of Digital in advertising

In 2021, Digital receivedmore than 50%of total media allocations from seven economic sectors: apparel and accessories (74%); electronics and computers (74%); culture, leisure, sport and tourism (63%); real estate (63%); services (56%); commerce (55%); and media (53%).

Top investment sectors by format

The Digital AdSpend 2021 study shows that the sectors that most invested insearch (search), in absolute terms, were commerce (R$4.2 billion), services (R$1.7 billion), electronics and IT (R$590 million), financial (R$386 million) and tourism (R$ $339 million). These five sectors represent 66% of investment insearch.

In terms of image, the sectors that contributed the most to this format, in absolute terms, were services (R$ 2.9 billion), commerce (R$ 1.7 billion), financial (R$ 1.3 billion), telecommunications ( R$933 million) and media (R$808 million). Together, these five sectors represent 83% of investment in image formats.

In video, the top 5 in investments, in absolute values, in this format, were the sectors of services (R$ 3.1 billion), commerce (R$ 1.2 billion), financial (R$ 866 million), telecommunications ( R$790 million) and electronics and IT (R$555 million) – together, these sectors represent 68% of the investment in the format.

Methodology

Digital AdSpend brings a strategic view of investments in digital media in the country, considering sectorial views and expectations for the coming periods. The study considers average CPM projections and calibrations to estimate advertising investment on platforms not presented in the coverage. There are more than 1,600 websites and portals covered in banner, video, desktop and mobile formats. Insearch, the report considers the largest and reference of search engines, Google. As for social networks, the reported data consider Facebook Mobile App, YouTube Desktop, YouTube Mobile Browser and YouTube Mobile App.

The capture is performed in a hybrid way, with a human panel and through robots capable of collecting direct and programmatic campaigns that enter all the sites and portals of Kantar IBOPE Media coverage, collecting the available ads. Advertising from all media is classified and harmonized according to the taxonomy and brand structure of the company that is a reference in the market, which allows a holistic and strategic view of the market for multimedia analysis.

Want to know more about the news? Don’t forget to follow the ADNEWS on social media and stay on top of everything!

The post Investment in digital advertising reached more than BRL 30 billion in 2021 appeared first on DNEWS.