The world dawned with heightened tensions over Russia’s recent invasion of Ukrainian territories. Militarily, the attacks are just beginning, but economically the impacts are already huge, especially for oil.

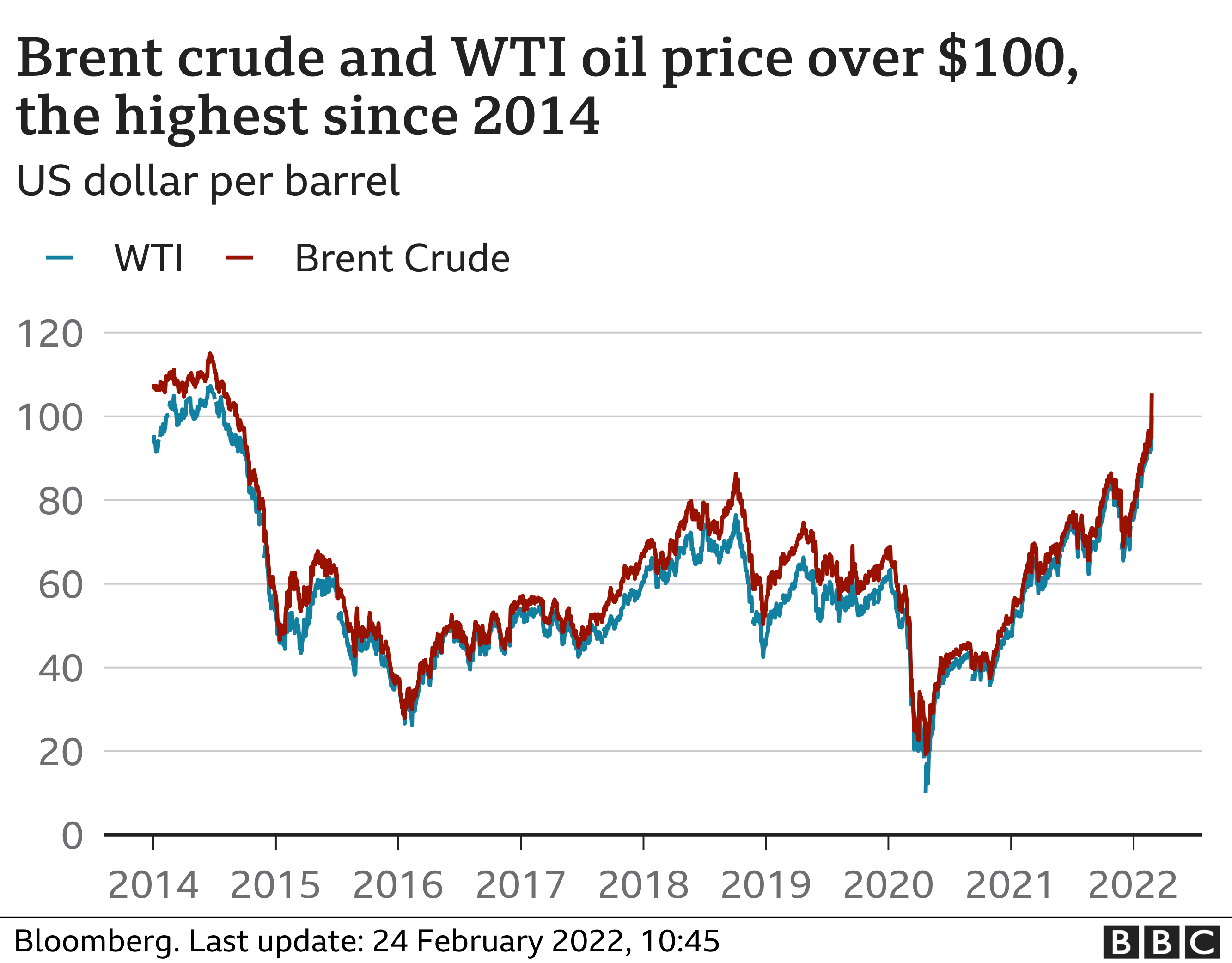

Global equities and exchanges such as Brazil, China and the United States plummeted, while the price of oil and gold rose, as did shareholder concern. The price of a barrel of oil reached $105 dollars.

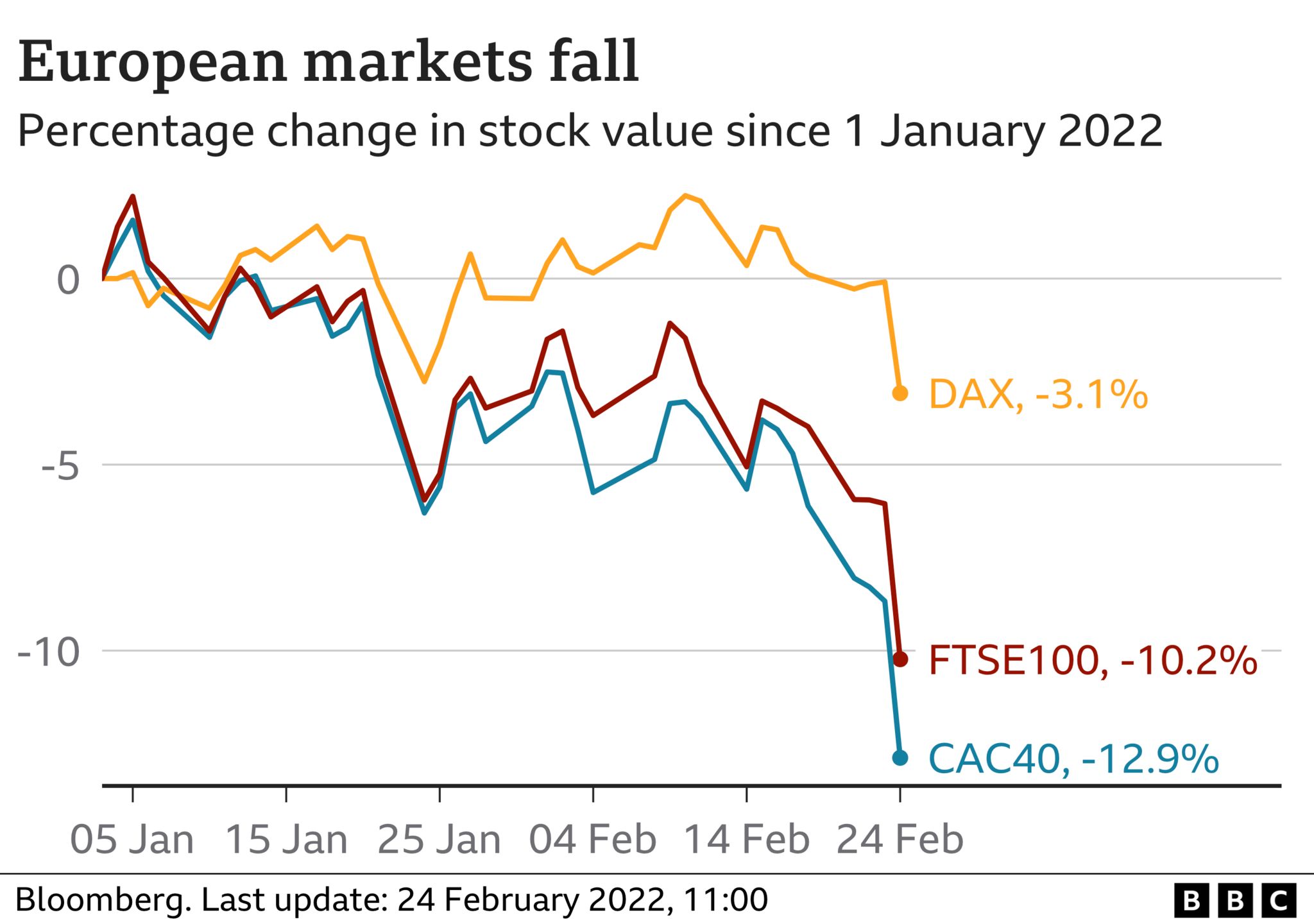

Russia is the second largest exporter of crude oil and also the world’s largest exporter of natural gas. Russian stock news led to sharp declines in equity markets across Europe, with the UK’s FTSE 100 index down over 3% and Germany’s Dax index down over 5.5%. Earlier, stocks in Asia also fell sharply. The price of gold – which is considered a safe-haven asset in times of uncertainty – jumped 3% to its highest price in more than a year.

Russ Mold, chief investment officer at AJ Bell, said the oil price hike “was terrible news for businesses and consumers” because “it will serve to further fuel inflation.” “Not only will energy bills continue to rise, but food prices are set to rise even further. Ukraine and Russia are major food suppliers and any disruption in supply will force buyers to look to alternative sources, which could drive up prices.”

Europe gets nearly a third of its oil and about 40% of its gas from Russia, much of it flowing through pipelines on Ukrainian territory. No wonder prices are going up.

Russia’s supplies don’t appear to have been affected – yet. But fears that they are, and that there could be a scramble for other resources, is driving up costs.

Equity markets across Europe are falling, with investors worried about the potential economic impact of high energy prices and the potential for much broader sanctions. And as for Russian stocks, a chart showing the performance of the MOEX stock exchange in Moscow looks like a cliff in the Ural Mountains today.

Check out the graphics:

Translated matter from BBC.

The post Oil hits $100 and stocks plummet with Russian invasion appeared first on DNEWS.