Apple maintains global leadership, NVIDIA and technology brands drive growth.

A Kantar BrandZ has released its 2024 report highlighting the 100 most valuable global brands. The total value of these brands increased by 20%, showing a strong recovery after the stock market crash in 2023. For the third year in a row, the Apple leads the ranking as the most valuable brand in the world, being the first to exceed US$ 1 trillion (around R$ 5.37 trillion) in brand value. In addition to the company led by Tim Cook, the top 5 is made up of Google ($753.5 billion), Microsoft ($712.9 billion), Amazon ($576.6 billion) and McDonald’s ($221.9 billion).

One of the new features this year was the NVIDIAwhich rose 18 positions to 6th place, with an increase in value of 178%, reaching US$ 201.8 billion (approximately R$ 1.09 trillion) Among the new entries in the Top 100 are lululemon (92nd place, worth US $20.6 billion) and Corona (100th position, worth US$ 19 billion).

The Technology Platforms and Business Services category grew 45%, driven by excitement about advanced AI. Across all 13 category rankings, Google Cloud, Booking.com and Chipotle are among the fastest growing brands. Brand value growth in 2024 was largely driven by the performance of technology brands, which contributed US$1.2 trillion (approximately R$6.4 trillion) of the US$1.4 trillion growth (approximately R$ 7.5 trillion) from the top 100 compared to the previous year.

Coca Cola rose seven places, reaching 10th place and increasing its brand value by 8%. Indian telecommunications provider Airtel grew 24%, making it the fastest in the global rankings. Chinese brands Shein (70th place, worth US$24 billion) and Nongfu Spring (81st place, worth US$22 billion) entered the global top 100. Brands like Pepsi (91st position, worth US$ 19 billion), Colgate (95th place, worth US$18 billion) and Pampers (in 100th place, worth US$17 billion) returned to the ranking.

To be eligible for the global ranking, brands must be owned by a company listed on a stock exchange or a private company with public finances. Kantar BrandZ’s methodology combines financial analysis with extensive measures of brand equity.

Check out the full ranking below:

The report shows that brands are entering a disruptive new era, with the total value of the world’s 100 most valuable brands in 2024 exceeding pre-pandemic growth expectations.

And Brazil?

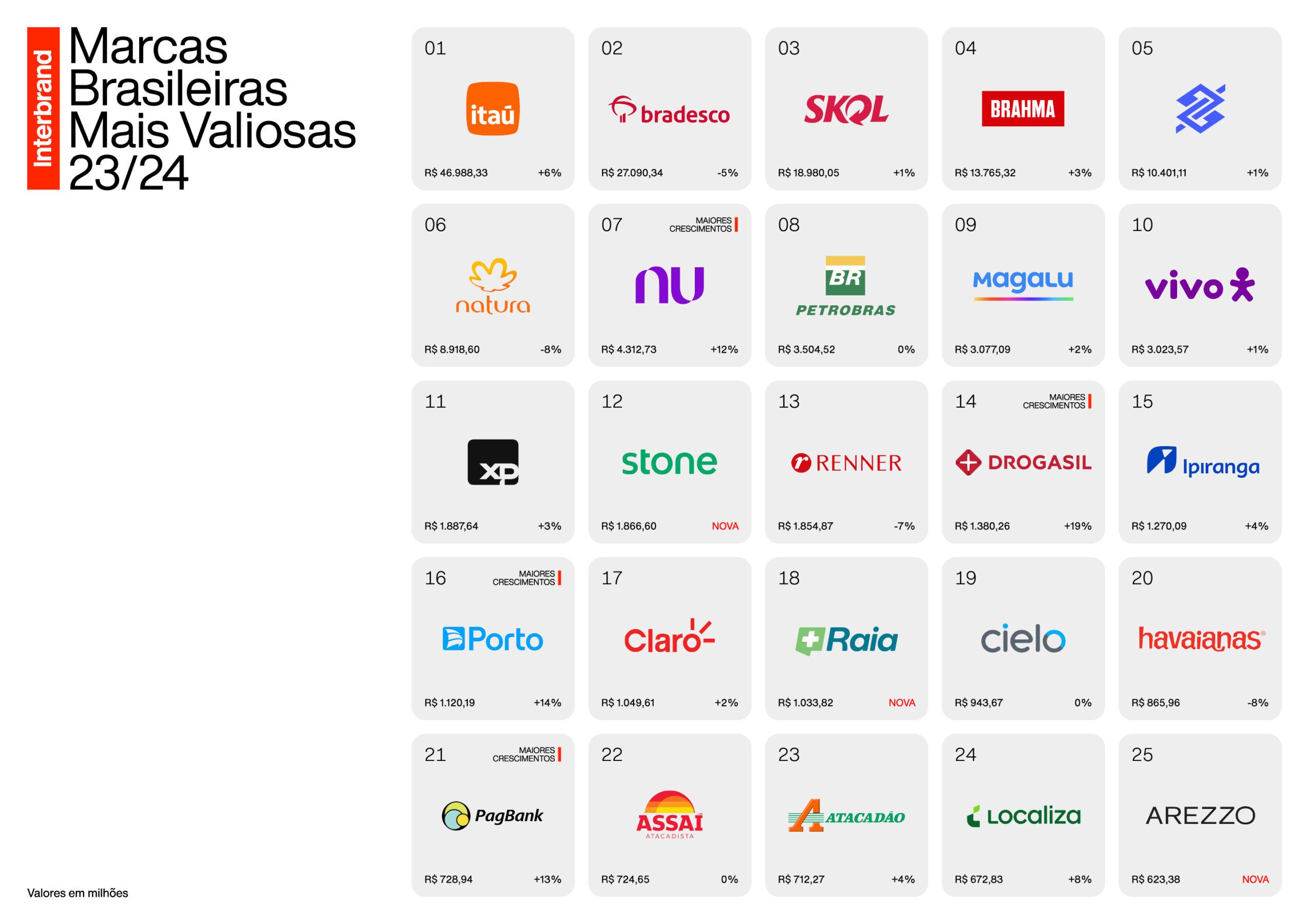

Interbrand revealed the “Most Valuable Brazilian Brands of 2023/2024”, with a total increase of 2% compared to the previous study, reaching a combined value of R$156 billion.

Interbrand reveals ranking of the most valuable Brazilian brands between 2023 and 2024 (Photo: Disclosure/ Interbrand)

Leading the ranking, the Itaú maintains its position with an estimated value of R$46.9 billion, followed by Bradesco with R$27 billion, School with R$18.9 billion, Brahma with R$ 13.7 billion and Bank of Brazil with R$10.4 billion.

Among the new features this year is the presence of fintech Stone, occupying 12th position with a brand value of R$1.8 billion. The analysis highlights the company’s consistent growth, driven by strengthening the product portfolio and building a solid connection with the public.

Another newcomer is Raia, which enters the ranking in 18th place, together with the return of Arezzo, occupying 25th position in terms of brand value.

Among the brands that grew the most in relation to the previous study, Drogasil stands out, with a 19% increase in its brand value, consolidating itself as the leading brand in the healthcare sector in Brazil.

Furthermore, Porto (14%), Banking (ex-Insurance) (13%) e Nubank (12%) also showed double-digit growth, while brands Renner (-11%), Havaianas (-11%) e Nature (-8%) suffered significant drops.

In a challenging year for companies, growth was driven by factors such as empathy, agility and trust, which played a key role in generating positive results. Brands that established an authentic and meaningful dialogue with their audiences, demonstrating commitment to causes relevant to society, achieved excellent financial performance.

Finally, it is worth highlighting that the top five brands in the ranking represent 75% of the total value, with the main sectors being financial services (60%), alcoholic beverages (20%) and cosmetics (5%).

The study methodology, developed in partnership with the London School of Economics, evaluates the financial performance, perception and influence of brands among consumers. This year, the analysis was complemented by a quantitative survey carried out by Provokers, interviewing 1,000 people across Brazil, from classes A, B and C, over 15 years of age.

*Cover photo: Disclosure/Kantar

Follow Adnews on Instagram e LinkedIn. #WhereTransformationHappens